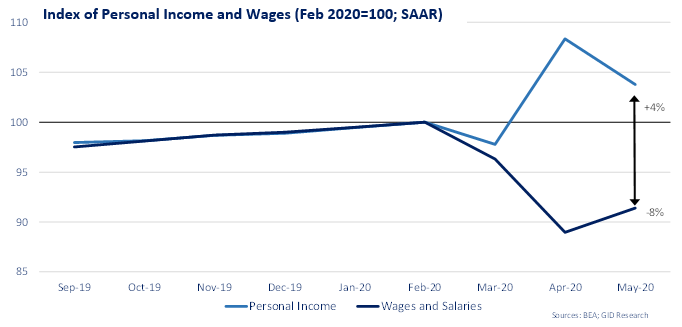

Household Incomes Up Despite the Pandemic: Headline income numbers mask underlying economic weakness; high frequency data may be a head fake.

Swift and unprecedented fiscal stimulus through the CARES act has boosted household incomes and put a floor under consumption…at least in the short term. The combination of $270 billion in one-time stimulus checks and generously amended unemployment benefits have more than compensated for the deficit in earnings created by the shutdown; total personal income, which includes wages and salaries as well as government transfers like unemployment benefits, was up 4%[1] from February, despite an 8% drop in wages and salaries. This is supporting consumption, which by some spot market measures may be nearing parity with year-ago levels. However, the stimulus is temporary and will eventually need to be replaced by more permanent wage growth.

The CARES act has been successful in supporting the U.S. economy in the short run:

- Households continue to spend. While May consumption levels were down 12% from February, this was up from the April nadir of -18% and, arguably, well above the potential decline that might be associated with current unemployment figures. Moreover, spot market spending via Bank of America credit and bank cards rebounded to year ago levels in the last full week of June, reflecting spending of stimulus checks and the unleashing of pent up demand in cities reopening their economies.

- Defaults have been suppressed. Consumer and business loans in “hardship” are rising, but on the level are about half the rate logged during the GFC. The stimulus checks and unemployment benefits have allowed most households to pay their bills through May, preventing more widespread breaks in the payment obligation chain. This has a positive feedback on the bond market and borrowing costs for households and businesses, and generally supports the price of real assets, including real estate.

- Households are primed to unleash pent-up demand. Unspent income (also known as savings) is up by 191% or $2.7 trillion over February levels to a record $6 trillion. This should help support spending over the rest of the summer and aid the U.S. economic recovery.

The CARES act performed as designed – creating a bridge to carry households across a deep, but temporary drop in wages. However, the benefits are also masking the effects of the lost income, and high frequency data like open table bookings and credit card spending may be a head fake that reflects pent up demand rather than meaningful recoveries. Worse, if the reopening falters, the benefits of these stimulus programs may run out before the underlying payrolls can recover. As such, GID will continue to monitor wage growth for signs of a true inflection point.

Please contact research@gid.com for additional information.

[1] Bureau of Economic Analysis. May 2020. Seasonally adjusted annual rates